Accelerate Your Real Estate Projects with Hard Money Loan Atlanta for Faster Profits

Accelerate Your Real Estate Projects with Hard Money Loan Atlanta for Faster Profits

Blog Article

Unlocking Opportunities: Why a Hard Money Funding May Be Right for You

Customized for residential properties that need quick procurement or remodelling, these car loans provide particularly to capitalists encountering credit history challenges or those with unconventional earnings streams - Hard Money Loan Atlanta. As the market grows significantly affordable, comprehending the tactical use of tough cash lendings could be important.

Comprehending the Essentials of Tough Cash Lendings

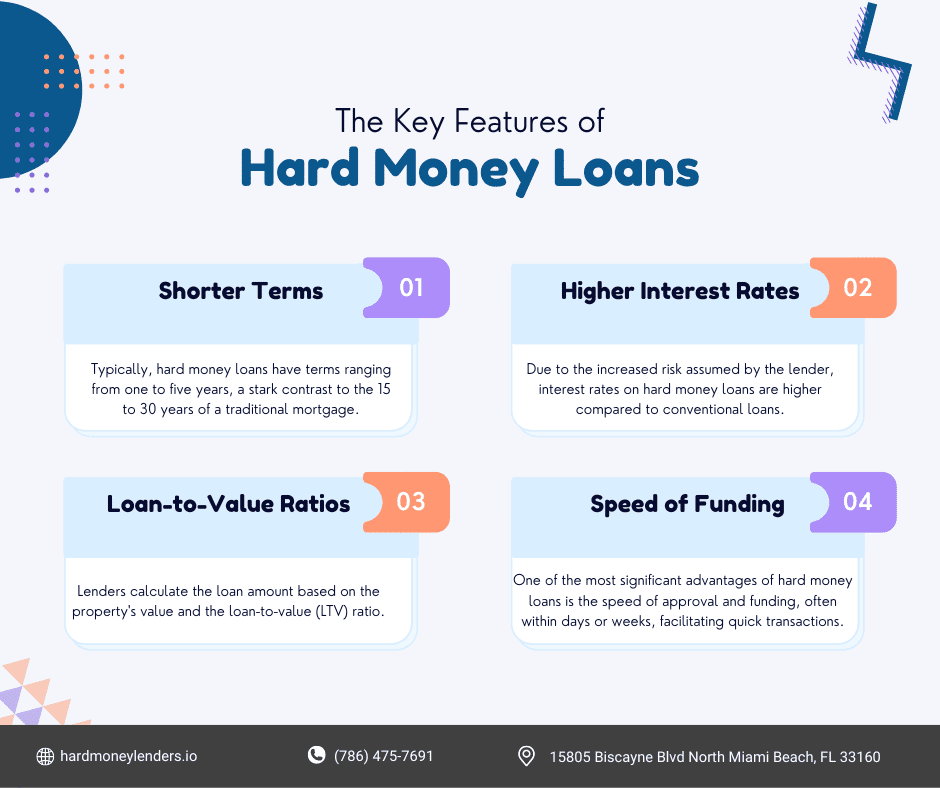

While traditional loans are commonly protected via financial institutions, tough money loans offer an alternative, primarily backed by the worth of the residential or commercial property itself. These financings are generally utilized by investor that need fast financing without the extensive documentation and authorization procedures needed by conventional financial methods. Tough cash lenders focus on the potential worth and marketability of the building instead than the borrower's creditworthiness.

Difficult cash fundings are distinguished by their short period, usually varying from one to 5 years, and they generally include greater rate of interest contrasted to traditional financial institution lendings. This sort of funding is specifically attractive in situations where fast cash is necessary for getting or renovating properties before turning them for an earnings. The approval process for a difficult cash funding can be substantially quicker, sometimes within just a few days, which is crucial in competitive actual estate markets.

Benefits of Hard Money Loans for Real Estate Investments

Difficult cash lendings use considerable benefits for real estate financiers, particularly in terms of versatility and rate. Furthermore, difficult money fundings supply a course for those that might not certify for standard lendings due to credit score issues or unique income sources (Hard Money Loan Atlanta).

These car loans also enable even more imaginative and aggressive financial investment techniques, consisting of fix-and-flips, land fundings, and building and construction tasks that typically do not get approved for typical funding. The capability to work out more why not try this out personalized settlement terms and schedules with tough money lenders can further boost their allure to investor, supplying them tailored options that much better straighten with the project timelines and money flow circumstances.

How to Safeguard a Tough Cash Car Loan and What to Consider

Safeguarding a difficult money financing calls for understanding both the loan provider's viewpoint and the integral threats involved. Investors have to first recognize appropriate hard money lending institutions that specialize in the particular type of genuine estate investment they are pursuing.

Final Thought

In final thought, difficult cash loans supply a useful service genuine estate investors looking for swift financing. By prioritizing property value over credit report, these fundings help with quick accessibility to funding for urgent jobs. While they feature greater rate of interest, the capability to protect funding swiftly and with much less stringent requirements makes them indispensable in affordable markets. Capitalists should very carefully assess the terms and consider their settlement approach to fully utilize the advantages of tough money lendings.

While traditional car loans are generally protected through banks, tough cash finances supply a choice, largely backed by the value of the property itself.Difficult money finances are distinguished by their short duration, frequently ranging from one to 5 years, and they normally come with greater interest prices contrasted to typical bank i loved this car loans.Hard cash financings provide significant advantages for genuine estate capitalists, specifically in terms of versatility and speed. Furthermore, hard money lendings provide a path for those that may not qualify for standard car loans due to credit rating issues or unusual revenue resources.

Report this page